The Ultimate Wealth-Building & Retirement Blueprint for Real Estate Professionals

Build lasting wealth and a secure retirement without sacrificing every weekend to close deals.

Learn How to Keep More Commission, Lower Taxes, and Build Passive Income for a Stress-Free Retirement

CLICK BELOW TO WATCH FIRST!

4.9/5 star reviews

Thousands of happy customers worldwide

AS SEEN ON

Discover Why Securing Your Financial Future Starts Here

Does this sound like you?

Paying thousands more in taxes than necessary.

Unpredictable income makes budgeting nearly impossible.

No clear retirement plan beyond the next commission check.

Overwhelmed by conflicting investment advice.

Mixing business and personal finances and creating cash-flow chaos.

Keep 20–30 % more of your commissions with proven tax strategies.

Own cash-flowing rentals that pay you while you sleep.

Follow a step-by-step roadmap to a secure retirement.

Invest confidently with vetted resources and clear criteria.

Build multiple income streams that work whether or not you're closing deals.

What You Get Inside This Wealth-Building Program

Financial Baseline & Goal Setting

Take stock of your finances, establish wealth goals, and create a personalized scorecard.

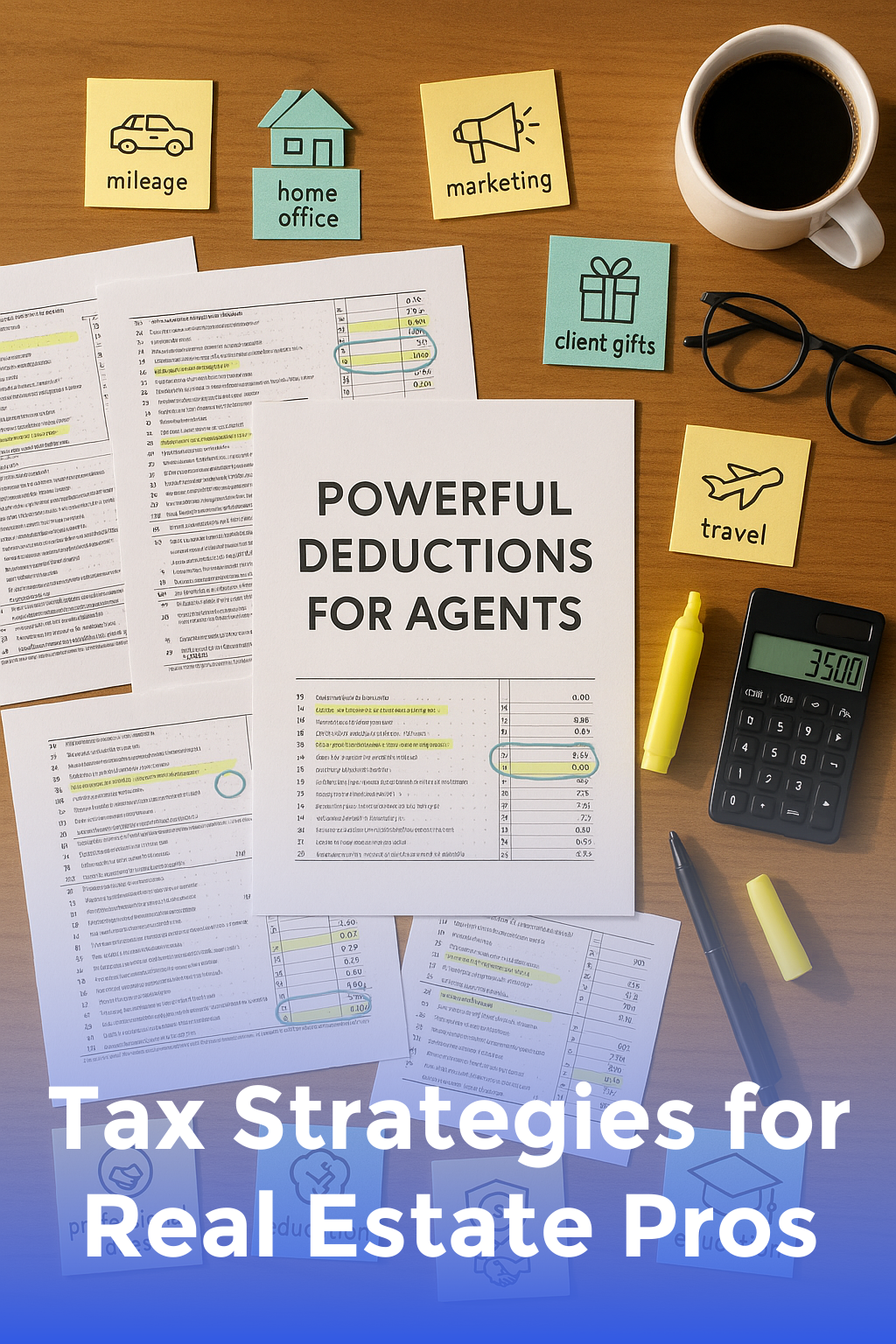

Tax Strategies for Real Estate Pros

Master legal tax strategies that let you keep up to 30 % more of every commission check.

Budgeting & Cash-Flow Management

Stabilize commission-based income with proven budgeting and cash-flow systems.

Asset Protection Essentials

Shield your wealth with LLCs, insurance, and other risk-management tools.

Smart Debt & Leverage

Leverage good debt to fund investments while keeping risk in check.

Building a Rental Portfolio

Acquire, finance, and manage rental properties that generate reliable passive income.

TESTIMONIALS

What our students are saying...

" In my second year as an agent, I doubled my savings and bought my first duplex thanks to this course. "

- Jessica Nguyen

" The tax module alone saved me $18,000 last year—worth every penny. "

- John Doe

" Finally, a retirement plan made for agents. I'm now on track to retire 10 years early. "

- Roberta Johnson

MODULES

FOLLOW MY STEP BY STEP VIDEO TRAINING

Financial Baseline & Goal Setting

Take stock of your finances, establish wealth goals, and create a personalized scorecard.

Tax Strategies for Real Estate Pros

Master legal tax strategies that let you keep up to 30 % more of every commission check.

Budgeting & Cash-Flow Management

Stabilize commission-based income with proven budgeting and cash-flow systems.

Asset Protection Essentials

Shield your wealth with LLCs, insurance, and other risk-management tools.

Smart Debt & Leverage

Leverage good debt to fund investments while keeping risk in check.

Building a Rental Portfolio

Acquire, finance, and manage rental properties that generate reliable passive income.

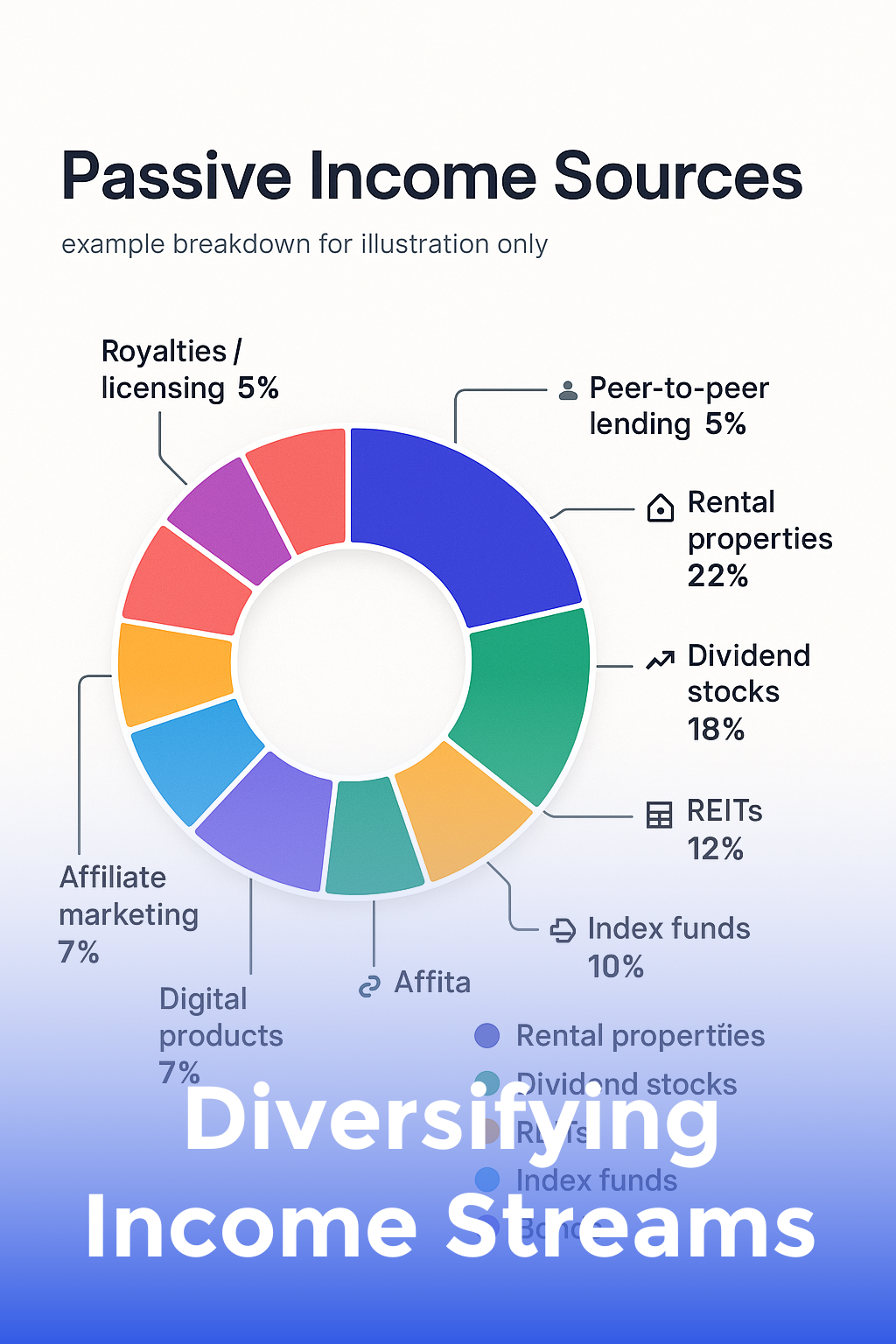

Diversifying Income Streams

Add diversified passive-income streams like REITs, note investing, and short-term rentals.

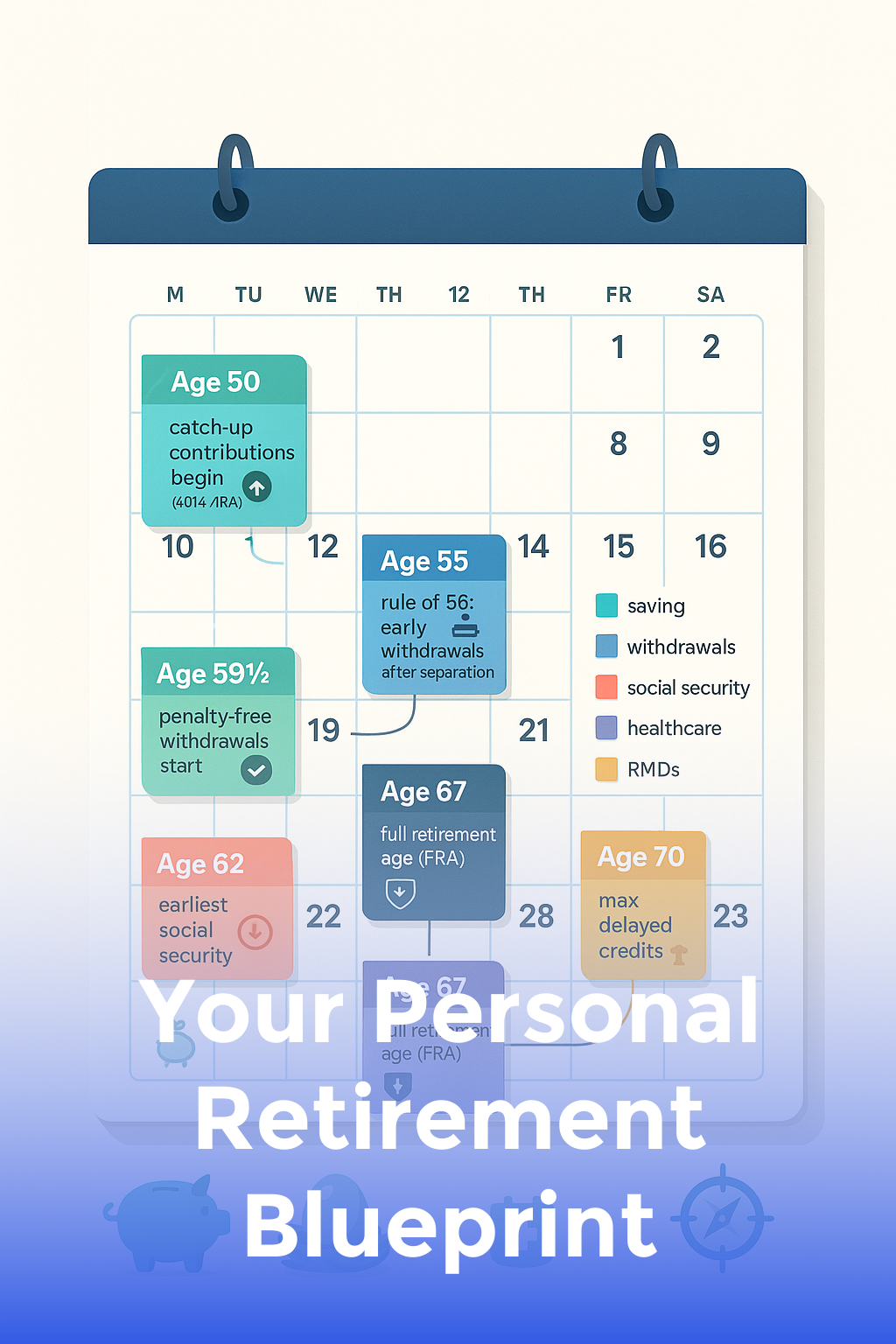

Your Personal Retirement Blueprint

Design a 10-, 20-, and 30-year roadmap to retire comfortably on your terms.

4.9/5 star reviews

Keep More Income, Grow Your Wealth, Retire Confidently

A comprehensive, step-by-step video program that shows real estate agents and investors how to optimize taxes, protect profits, and build long-term, passive income.

Here's what you get:

Instant access to 40+ concise, actionable video lessons.

Downloadable tax-strategy templates, spreadsheet calculators, and legal-checklist PDFs.

Private members-only community of growth-minded real-estate professionals.

Lifetime updates as laws, strategies, and market conditions change.

Today Just

$997 one time

"Best purchase ever!"

" The tax module alone saved me $18,000 last year—worth every penny. "

ABOUT YOUR INSTRUCTOR

Meet Natalie

Led by a CPA-turned-real-estate-investor with over 20 years of experience helping clients legally slash taxes, scale property portfolios, and retire early.

After watching high-earning agents struggle to hold onto their money, he realized what was missing: a practical, real-estate-specific wealth plan. This course is the solution.

Graduates routinely save 20–30 % more of their commissions, close on cash-flowing properties within 12 months, and set retirement dates years ahead of schedule.

Helped clients save more than $50 M in taxes.

Personally owns and manages a $40 M rental portfolio.

Featured financial expert in BiggerPockets, Forbes, and REALTOR® Magazine.

Guided over 2,000 agents to their first investment property.

Retired from public accounting at age 42 thanks to real-estate cash flow.

Keynote speaker at National Association of REALTORS® Wealth-Building Summit.

WHO IS THIS FOR...

Ideal for real estate agents, brokers, property managers, and investors who want a clear, proven plan for financial freedom.

Real Estate Agents

Brokers

Property Managers

Wholesalers

Real Estate Investors

House Flippers

Short-Term Rental Hosts

Real Estate Team Leaders

STILL NOT SURE?

Satisfaction guaranteed

We want you to find value in our trainings! We offer full refunds within 30 days. With all of our valuable video training, we are confident you WILL love it!

STILL GOT QUESTIONS?

Frequently Asked Questions

Will this course help me reduce taxes?

Absolutely. You'll learn up-to-date, legal tax strategies tailored for real-estate pros, from entity selection to deductions and retirement accounts.

Do I need prior investing experience?

No. We start with the basics and guide you step by step—from your first investment to a diversified portfolio.

How is this different from generic finance courses?

Every lesson is built around the commission-based income, schedule, and opportunities unique to real-estate professionals—it's finance by agents, for agents.

Enroll in the course now!

Copyrights 2024 | Real Estate Wealth Blueprint™ | Terms & Conditions